Lawyers specialising in order for payment proceedings

- An order for payment proceedings may be brought by a person who seeks from another person payment of a monetary debt, due and payable, of a specific amount not exceeding 250,000 euros, where the debt of that amount is evidenced in one of the following ways:

- 1ª Mediante documentos, cualquiera que sea su forma y clase o el soporte físico en que se encuentren, que aparezcan firmados por el deudor o con su sello, impronta o marca o con cualquier otra señal, física o electrónica, proveniente del deudor.

- 2ª By means of invoices, delivery notes, certifications, telegrams, telefaxes or any other documents which, even if created unilaterally by the creditor, are those that usually document the credits and debts in relations of the type that appear to exist between creditor and debtor.

- Without prejudice to the provisions of the preceding paragraph and in the case of debts that meet the requirements set out in that paragraph, the order for payment procedure may also be used for the payment of such debts in the following cases:

- 1º When, together with the document recording the debt, commercial documents are provided that prove a previous lasting relationship.

- 2º When the debt is accredited by means of certificates of non-payment of amounts owed in respect of common expenses of Communities of owners of urban properties.

Initial application for an order for payment

- The order for payment procedure shall begin with an application by the creditor stating the identity of the debtor, the domicile or domiciles of the creditor and the debtor or the place where they reside or where they can be found and the origin and amount of the debt, accompanied by the document or documents referred to in Article 812. The petition may be drawn up on a form that facilitates the expression of the points referred to in the previous paragraph.

- It shall not be necessary to be represented by a solicitor and a lawyer for the submission of the initial application for an order for payment.

Commercial law news

Unfair competition, also known as unlawful competition, is one of the most complex issues in the field of commercial law. Because it can occur in an infinite...

Business accelerators are organisations or programmes that provide support and resources to startups and entrepreneurs in the early stages of their company's...

Illiquidity refers to the inability of an entity or individual to convert assets into cash quickly without incurring significant losses. In other words, it is...

The mandate contract is an agreement in which a person, called the principal, entrusts another person, called the agent, with the performance of certain actions...

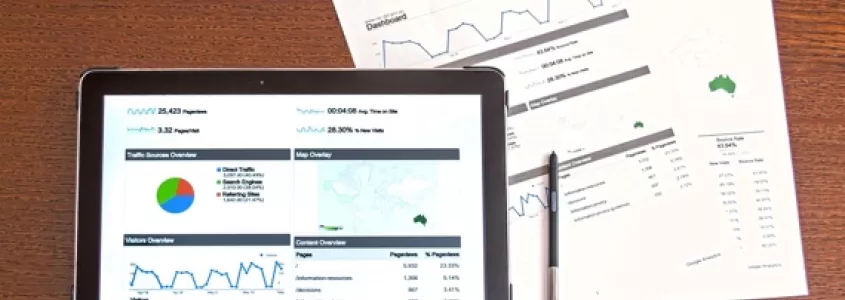

Due diligence is a process of thorough investigation and analysis undertaken to evaluate a company, an individual or an investment opportunity. The objective of...

A surety is a guarantee offered to ensure the fulfilment of a contractual or legal obligation. It is a contract whereby a third party, called a surety or...

A company's articles of association are a legal document that sets out the rules and regulations governing the organisation and operation of a company. These...

An offshore company is a legal entity created in a foreign country for commercial, financial or tax purposes. The term "offshore" refers to the fact that the...

A pledgee is a person or entity that has a security interest in movable or immovable property that has been pledged as security for a debt. In other words, it...

The venture capital is a form of financing companies in early-stage or growth companies involving venture capital investment in emerging companies and startups...

A corporate restructuring process is a strategy used to improve the efficiency and effectiveness of a company. In general, restructuring involves significant...

A capital reduction is a financial operation that consists of reducing the nominal value of a company's share capital. This can be done for different reasons, e...