Commencement of the insolvency proceedings

Article 5 of the Insolvency Act establishes that the debtor must apply for the declaration of insolvency within two months of the date on which it became aware or should have become aware of its state of insolvency.

The Insolvency Act defines the scope of the debtor's liability in the event of actions contrary to the interests of the insolvency estate.

Although it is true that the insolvency proceeding, or rather the declaration thereof, is an action of a mandatory nature, it is also an obligation with regard to the debtor, the non-fulfilment of which may entail serious consequences.

On the other hand, and although the Insolvency Act does not expressly state this, the declaration of insolvency is also a right of the debtor, since if the requirements are met, the debtor cannot be denied this right.

A distinction must be made between current insolvency and imminent insolvency.

- In the case of imminent insolvency, the application for insolvency proceedings is a power of the debtor and only of the debtor. Creditors cannot file for insolvency proceedings against the debtor in the event of imminent insolvency.

- On the contrary, the debtor has the duty to file for insolvency proceedings when his insolvency is actual. Thus, according to Article 5.1 LC, the debtor has the duty to request the declaration of insolvency proceedings within the two months following the date on which he knew or should have known of his state of insolvency and it is presumed, in the absence of proof to the contrary, that the debtor has known of his state of insolvency when certain events occur that allow the request for insolvency proceedings to be made. Pursuant to Article 5.2 LC, the debtor must apply for insolvency proceedings within two months of the occurrence of any of the external events that reveal the insolvency of Article 2.4 LC; that is to say, the debtor must apply for insolvency proceedings within two months of the occurrence of any of the external events that reveal the insolvency of Article 2.4 LC; that is:

- The general suspension in the current payment of the debtor's obligations.

- The existence of liens due to pending executions that affect the debtor's assets in general.

- The hasty or ruinous liquidation of the debtor's assets by the debtor.

- Generalised non-fulfilment of any of the following types of obligations: payment of tax obligations due during the three months prior to the application for insolvency proceedings; payment of Social Security contributions and other jointly collected items during the same period; payment of salaries and compensation and other remuneration arising from employment relationships corresponding to the last three monthly payments. In this case, once the three monthly payments have elapsed, the debtor must apply for insolvency proceedings within two months of the expiry of the aforementioned period.

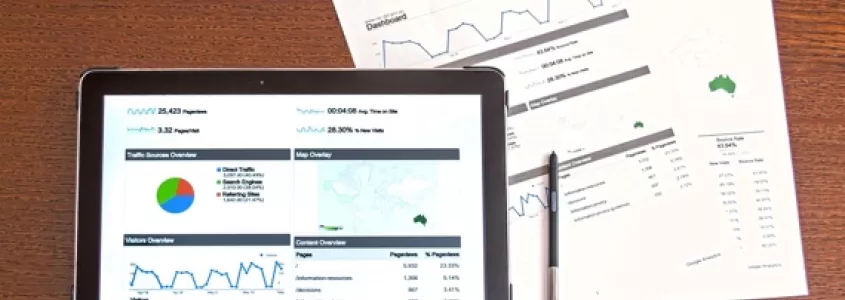

News on insolvency law

Unfair competition, also known as unlawful competition, is one of the most complex issues in the field of commercial law. Because it can occur in an infinite...

Business accelerators are organisations or programmes that provide support and resources to startups and entrepreneurs in the early stages of their company's...

Illiquidity refers to the inability of an entity or individual to convert assets into cash quickly without incurring significant losses. In other words, it is...

The mandate contract is an agreement in which a person, called the principal, entrusts another person, called the agent, with the performance of certain actions...

Due diligence is a process of thorough investigation and analysis undertaken to evaluate a company, an individual or an investment opportunity. The objective of...

A surety is a guarantee offered to ensure the fulfilment of a contractual or legal obligation. It is a contract whereby a third party, called a surety or...

A company's articles of association are a legal document that sets out the rules and regulations governing the organisation and operation of a company. These...

An offshore company is a legal entity created in a foreign country for commercial, financial or tax purposes. The term "offshore" refers to the fact that the...

A pledgee is a person or entity that has a security interest in movable or immovable property that has been pledged as security for a debt. In other words, it...

The venture capital is a form of financing companies in early-stage or growth companies involving venture capital investment in emerging companies and startups...

A corporate restructuring process is a strategy used to improve the efficiency and effectiveness of a company. In general, restructuring involves significant...

A capital reduction is a financial operation that consists of reducing the nominal value of a company's share capital. This can be done for different reasons, e...